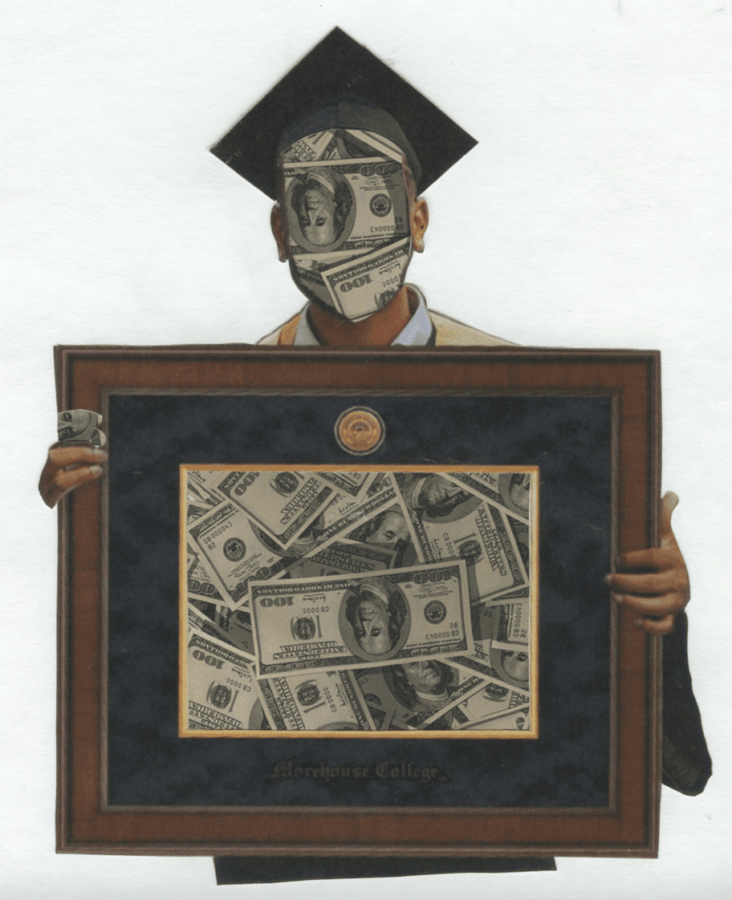

Why We Should Forgive Student Loan Debt

April 15, 2023

Each year, young Americans are faced with the difficult decision of taking out student loans to fund their college education. As a result, over 44 million Americans owe a combined $1.7 trillion in federal student loans. With the demand for student loan forgiveness increasing, I strongly agree that we should cancel—or at the very least provide relief to—student loan debt.

In 1987, it cost, on average, when adjusting for inflation, $39,643 to pay for an undergraduate degree at a private four-year university. This number nearly tripled thirty-six years later, now costing an upwards amount of $103,616 to earn the same type of degree. The problem is that the average wage of an early-career, college-educated worker remains nearly the same. When adjusting for inflation, the average salary from 1987 to the present day increased from $49,406 to $50,556—a roughly 2% increase. It is unfair to force newly-graduated Americans to pay these rising college costs when their wages remain unchanged. In a society where many jobs require a four-year degree, students are now forced to take on thousands of dollars in student loans to obtain a stable and livable income. Therefore, we should cancel student loan debt to assist many Americans in this debt crisis.

The argument for providing student loan relief is further reinforced when considering who would receive such benefits. The debt-to-income ratio is used to gauge how taxing student loan debt is to individuals depending on their income. The closer, and possibly even higher, the ratio is to 1, the more a person’s income is spent paying their student loans. Likewise, if the ratio approaches 0, the individual spends a small percentage of their income paying off their debt. This number is achieved by dividing an individual’s outstanding student loans by their annual income. The debt-to-income ratio of those in the bottom 50% by income is around 1. Those in the top 10% only have a debt-to-income ratio of approximately 0.125. Student loan forgiveness would benefit low-income Americans the most, as they give the most significant percentage of their income to paying off their debt. As such, canceling student debt will give these citizens more financial freedom.

Not only will student loan forgiveness help those in need, but it will also assist those unsure about attending college due to the cost. Many Americans, especially those of low-income backgrounds, want to earn a higher education but are discouraged by the ever-rising cost of attending university. This effect is seen in a CNN study, showing that 77% of individuals went to college from households earning $108,650 annually or more. In comparison, only 9% went to college if they came from families earning less than $34,160 annually. Canceling student loan debt will encourage those from low-income backgrounds to attend college, as it will set a precedent for the government to assist those who need it the most. Instead of hyper-focusing on the idea that providing student loan relief will encourage people to amass large quantities of debt, knowing they cannot afford it, we should acknowledge the increase in opportunities many Americans will have, granting them access to higher-paying employment.

Recently, the call for student loan debt forgiveness has been addressed by President Joe Biden, as he announced his three-part plan to provide student loan relief. In this plan, Mr. Biden aims to do the following: provide target debt relief by canceling up to $10,000 of student debt to individuals earning under $125,000 per year, making the student loan system more manageable for current and future borrowers, and reducing the cost of college by holding universities accountable for spikes in price. This plan is an executive order and therefore does not have to pass in the House or Senate. Even so, there has been considerable pushback against Biden’s plan. Many, such as Senate Minority Leader Mitch McConnell, have voiced their concerns that this could increase inflation. Due to this significant opposition, the enactment of the student loan forgiveness plan has been halted and is currently being reviewed by the Supreme Court.